Consumers and distributors navigate a new landscape that could change the pay-TV system. Is there a breaking point?

This has been an autumn filled with frustration at BrewCo, a microbrewery in Manhattan Beach, Calif.The bar, which is about two blocks from the ocean, typically is packed on college football Saturdays, particularly with USC alums filling up the place to cheer on the local football team.

But those crowds did not materialize for two USC football games this year: the Sept. 22 game against Cal and the Oct. 20 Colorado game. Those games were carried exclusively on Pac-12 Networks, which launched in August and isn’t carried by DirecTV. Like many bars and restaurants in the Los Angeles area, BrewCo subscribes to DirecTV, so it couldn’t show the games.

“This place was empty,†said bartender Scott Mikolaycik. “It’s disappointing when people walk in and ask if we have the game on, and we don’t.â€

|

| DirecTV customers in the Los Angeles market have been shut out of some Pac-12 football games because DirecTV has yet to reach a carriage deal with the Pac-12 Networks. Photo by:Â Getty Images |

Compounding Mikolaycik’s frustration last month was the fact that DirecTV hadn’t yet cut a deal with Time Warner Cable for the Lakers’ two new channels, TWC SportsNet and TWC Deportes, and the NBA season was only a week away from starting.

With the launch of those three RSNs in the past two months, Los Angeles has become a sort of ground zero for sports media, with consumers, businesses, distributors and rights holders trying to navigate a new sports media landscape where local rights are divided among a growing number of high-priced sports channels.

Add in the possibility of the Dodgers starting their own channel when their rights deal with Fox ends after next season (sources say that remains an option), and local rights in Los Angeles would become more expensive and spread out than in any other U.S. market.

It’s a situation that has frustrated consumers as they face a sports media marketplace that has become more fractured, more expensive and more confusing. It’s also brought complaints from distributors who have to pay considerably more for basic access to the same games they’ve always carried.

If the Los Angeles model proves successful, the tremors could be felt throughout the country as other big markets that have multiple professional and college sports teams give it a try. Some even say it could change the entire pay-TV system.

“I’m worried that it could become a trend in other markets,†said Bob Wilson, the top programming executive at Cox Communications. “Everybody’s watching the Lakers and the Dodgers to see what the market will absorb. We’ve been on this path for a long time now. We all are wondering where the breaking point is.â€

Model of frustration

Time Warner Cable SportNet

Time Warner Cable Deportes

Launch date: October 2012

Rights: Los Angeles Lakers, Los Angeles Galaxy

Top distributors: Time Warner Cable, Verizon, AT&T, Charter, Bright House

Top executives: David Rone, president, Time Warner Cable Sports; Mark Shuken, senior vice president and general manager, Time Warner Cable Sports regional networks; Dan Finnerty, senior vice president, Time Warner Cable Sports

Pac-12 Networks

Launch date: August 2012

Rights: Pac-12 Conference home football and basketball games not carried by ESPN and Fox, and select additional conference sports events

Top distributors: Comcast, Dish Network, Time Warner Cable, Cox, Bright House

Top executives: Gary Stevenson, president of Pac-12 Enterprises; Lydia Murphy-Stephans, executive vice president and general manager, Pac-12 Networks; and Art Marquez, senior vice president of affiliate sales and marketing, Pac-12 Enterprises.

Fox Sports West

Launch date: October 1985

Rights: Los Angeles Angels, Los Angeles Kings, Big West Conference, Pac-12 Conference basketball

Top distributors: Time Warner Cable, DirecTV, Dish Network, Verizon, AT&T, Charter

Top executive: Steve Simpson, senior vice president and general manager

Prime Ticket

Launch date: January 1997

Rights: Los Angeles Dodgers, Los Angeles Clippers, Anaheim Ducks

Top distributors: Time Warner Cable, DirecTV, Dish Network, Verizon, AT&T, Charter

Top executive: Steve Simpson, senior vice president and general manager

Source: The networks

It’s not clear how many subscribers are not able to see the Pac-12 Networks, TWC SportsNet and TWC Deportes in Los Angeles right now. The TWC networks, in particular, signed several carriage deals in the week before the NBA season opener, and its executives expected to have more signed before the Lakers’ official opening tipoff.

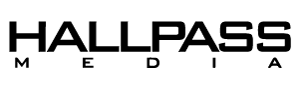

But those deals did little to assuage some of the concerns of the Lakers fan base. At press time last week, the Los Angeles market’s second-largest distributor, DirecTV (with more than 1.2 million subscribers in Los Angeles), still had not signed up for either of the TWC channels or the Pac-12 Networks.

That meant that consumers and bars, like BrewCo, had to make contingency plans. Mikolaycik said his bar was looking into hooking up at least one of its televisions to Time Warner Cable to get access to the first Lakers games.

Last year, USC football games and Lakers basketball games were available to most pay-TV subscribers throughout the Los Angeles market. USC games were on local broadcast channels and the Lakers were on Fox Sports West. This year, many of those subscribers are being shut out.

“I’m frustrated that the cable companies are allowed to do this,†Mikolaycik said.

He’s not alone in venting. During an Oct. 13 preseason game between the Lakers and the Utah Jazz, fans in the Staples Center booed the in-arena video ads touting the new Time Warner Cable regional sports networks with such gusto that Time Warner Cable stopped running them.

“There’s just general frustration in the market. They want the product. We want to give them the product,†said Scott Pruitt, vice president of marketing and communications for TWC Sports Regional Networks. “It’s a Lakers environment. We don’t need to put our message down their throats all the time.â€

Distributors see the new channels as a drag on their profits. Regional sports networks make up some of the most expensive channels on pay-TV systems. Three of these channels launching in one market means a significantly higher carriage fee payout for all the local distributors.

Up until August of this year, the Los Angeles market was served by two RSNs, both operated by Fox Sports Networks. On average, distributors paid $2.63 per subscriber per month for Fox Sports West and $2.56 for Prime Ticket this year, according to media research firm SNL Kagan.

That changed in August, with the launch of the Pac-12 Networks, which can carry up to three football games from each of the conference’s schools. Sources said the conference charges around 80 cents per subscriber per month for its main channel in Los Angeles.

Time Warner Cable launched its RSNs — one in English and one in Spanish — on Oct. 1, and charges distributors in the Los Angeles market around $3.95 per subscriber per month for both.

All told, that means that cable and satellite operators are paying close to $10 per subscriber per month to access all of the RSNs in Los Angeles, an increase of more than 90 percent for the rights to Los Angeles sports.

Only New York distributors, with their four RSNs, cost more, according to SNL Kagan’s numbers. MSG ($2.63), MSG Plus ($2.28), SportsNet New York ($2.55) and YES Network ($2.99) total $10.68 per subscriber per month.

Why do it?

Time Warner Cable’s biggest business is as a distributor itself, where it has gained a reputation for conducting tough carriage negotiations with sports channels such as NFL Network and MSG Network.

Now, Time Warner Cable is the one with high-cost sports channels, and other distributors are the ones complaining about them. DirecTV and Cox went public last month with complaints about the high cost of the Lakers channels.

Wilson, whose Cox Communications has about 247,000 subscribers in the Los Angeles market, worries that the strategies being used by Comcast and Time Warner Cable could threaten the entire pay-TV business if their business plan is used in other markets.

“This has been a really good business model for a long time,†Wilson said. “You intuitively have to have some understanding that as we go forward more people will be increasingly priced out of the product.â€

|

| With the NBA regular season rapidly approaching, Time Warner Cable was trying to secure carriage deals for its two regional sports networks, with rights to the uber popular Lakers serving as bait. Photo by:Â Time Warner Cable Sports |

The rising cost of sports rights is one of the reasons why Cox decided to shutter its own RSNs earlier this year. Cox opted not to bid on the New Orleans Hornets or San Diego Padres rights this year in an attempt to prevent a bidding war that could cause those rights to climb too high. Fox Sports’ RSNs eventually gained rights to those two teams, and Cox signed long-term carriage deals with the networks.

Cox was the dominant cable operator in both of those markets. But Wilson said the cost of sports rights had been increasing so rapidly that it stopped making financial sense for Cox to keep those rights.

“We didn’t control the entire marketplace in those areas,†Wilson said, adding that negotiations with other distributors were becoming problematic as rights fees rose. “And we feel that more bidders has the effect of driving rights fees up disproportionately. I’m not saying that’s right. That’s the path we chose. Others have chosen different routes.â€

Those “others†include the country’s two biggest cable operators: Comcast and Time Warner Cable. Comcast has a long history of operating RSNs, most recently launching one in Houston with Rockets and Astros rights that previously had been controlled by Fox.

Time Warner Cable’s effort is in Los Angeles with Lakers rights that previously had been controlled by Fox.

Both companies have talked about the desire to cut out the “middleman†(that is, Fox Sports Networks) and deal with rights holders on their own.

One problem is that these deals rarely get rid of the middleman, as evidenced by MSG’s two channels that still operate in New York years after they lost rights to the Yankees and Mets.

There’s little reason to think that Fox will abandon any of its RSNs in Los Angeles or Houston just because it lost the rights to carry some games.

|

Take Los Angeles, for example. Fox still has long-term contracts that will keep Fox Sports West and Prime Ticket on cable, satellite and telco systems regardless of whether they have the rights to the Lakers. Fox has no financial incentive to merge the two channels into one and believes it has enough programming to support two channels, with two pro teams per channel.

Fox signed the Angels to a long-term deal last year, giving the baseball team equity in Fox Sports West. It also has a long-term deal with the NHL Kings that was signed earlier this year. It has the Ducks rights until 2015, and it has the Clippers rights until around 2017.

Its only potential stumbling block, and it’s a big one, is the Dodgers, whose rights expire after next season. Fox is in the middle of an exclusive negotiating widow with the Dodgers to keep the rights to the team on Prime Ticket. It’s too early to report on how those negotiations are going. Fox has made a big push to keep those rights, and Time Warner Cable has been open about wanting the chance to bid on them.

Another problem is that the high cost of entry for Time Warner Cable and Comcast’s channels works to set the market for the middlemen in other areas.

“What’s happening in places like L.A. and Houston is that other companies are reinforcing what we have said all along — that live sports is the most valuable product on the dial,†said Jeff Krolik, executive vice president for Fox Sports Networks. “And we’re looking forward to continuing to maximize that value for our 20 RSNs.â€

Blame it on New York?

The trend of having multiple RSNs in a market started in New York a decade ago. Ten years ago, the Yankees left MSG Network to start YES Network; and six years ago the Mets left MSG to launch SportsNet New York.

While teams have launched their own channel in various markets over the years — see MASN in Baltimore and Washington — the three new RSNs in Los Angeles more closely mirror New York than other markets.

For Time Warner Cable, the chance to partner with the Lakers was too good to pass up.

The hold the team has on the market was evident Oct. 24 during a Lakers preseason game against the crosstown Clippers. The Lakers hadn’t won a preseason game yet and the team announced that two of its star players — Kobe Bryant and Dwight Howard — were not going to play. Yet Staples Center was packed with a sold-out crowd of 19,060.

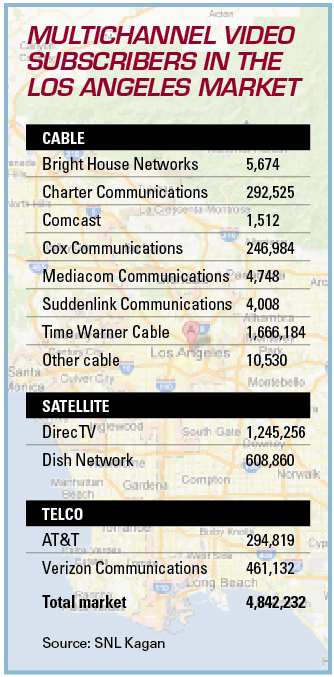

TV ratings for the three-week-old TWC SportsNet also demonstrate the team’s popularity in Los Angeles.

According to Nielsen numbers, the game pulled a 0.92 rating on TWC SportsNet, compared to a 2.02 on Prime Ticket, which also carried the game as the Clippers’ rights holder. The Lakers’ pregame show pulled a 0.44 on TWC SportsNet, comparable to a 0.48 for the Clippers’ pregame on Prime Ticket.

“We did that on 70 percent less distribution,†said Time Warner Cable Sports President David Rone. “I’ve been in Los Angeles for 21 years. I don’t think I appropriately grasped how passionate this marketplace is about the Los Angeles Lakers.â€

|

As an example, Rone referenced the 70,000 emails generated from its IWantMyLakers.com website, calling on distributors to carry the channel. But he easily could have pointed to television ratings over the past several years, which have showed the Lakers’ popularity in the market better than, perhaps, any other metric.

Until the Dodgers’ local TV ratings surged this summer, you could have added the television viewing audiences of the Dodgers, the Clippers, the Angels, the Kings and the Ducks, and together they would about equal the Lakers’ annual average audience.

Rone also points to the channels’ programming strategy as a model that he expects other RSNs to copy, particularly with respect to non-event programming that provides behind-the-scenes access for viewers.

“We believe that’s going to resonate with fans,†he said. “I think that most teams, when they look at the way in which the Lakers and Galaxy and Sparks are being exposed to their fan base, they are going to be desirous of that.â€

Ed Desser, president of Desser Sports Media, who worked on the Lakers deal with Time Warner Cable, agreed.

“The programming philosophy for TWC SportsNet is different than anything done before,†Desser said. “People will look back on the amount of original team-related programming with the amount of access and view it as a turning point for what regional sports networks should look like.â€

Industry executives are focused on the Los Angeles market to see whether it can sustain five high-cost RSNs.

Consensus is there are only a few markets that could support three or four RSNs. Those markets have to be big and have three or four professional teams — markets like Chicago, Desser said. He cited the ratio of two teams to one regional sports network as “sustainable.â€

“Big markets are where these types of deals tend to happen,†Desser said. “There’s more competition. There’s more sports content.â€

Chris Bevilacqua, a sports media consultant with Bevilacqua Helfant Ventures who worked on the Pac-12 deal, agreed.

“You’re going to see a trend with sports rights owners going direct to distributors, especially in bigger, dense markets,†Bevilacqua said. “In most cases, local sports franchises are the most valuable part of their market. In Los Angeles, the local teams are must-have programming.â€

Bevilacqua conceded that five or, maybe, six RSNs may be too many for one market. He said he wouldn’t be surprised to eventually see some consolidation in the Los Angeles market.

“There’s got to be a rationalization of the market,†he said. “It’s hard to see five or six RSNs in one market.â€

A look inside L.A.’s big league demographics

To read: Men age 55 years and older make up 19 percent of the Angels’ fan base, which (as shown by the “Index†column) is 41 percent more likely than Los Angeles’ general population. In comparison, 13 percent of the team’s fans are women 55 years or older, which is 18 percent less likely than the general population.

| Base Total | L.A. Angels | L.A. Dodgers | L.A. Lakers | L.A. Clippers | L.A. Kings | L.A. Galaxy | Chivas USA | ||||||||

| Los Angeles | % | Index | % | Index | % | Index | % | Index | % | Index | % | Index | % | Index | |

| Gender | |||||||||||||||

| Men | 49% | 62% | 126 | 61% | 123 | 60% | 121 | 71% | 144 | 66% | 135 | 69% | 139 | 64% | 129 |

| Women | 51% | 38% | 74 | 39% | 77 | 40% | 80 | 29% | 57 | 34% | 66 | 31% | 62 | 36% | 72 |

| Age | |||||||||||||||

| Men | |||||||||||||||

| 18 – 34 | 17% | 21% | 123 | 22% | 129 | 22% | 131 | 28% | 166 | 28% | 164 | 24% | 141 | 19% | 111 |

| 21 – 34 | 13% | 17% | 125 | 18% | 134 | 17% | 127 | 23% | 171 | 21% | 156 | 19% | 139 | 14% | 104 |

| 25 – 49 | 24% | 28% | 118 | 29% | 119 | 29% | 118 | 35% | 145 | 35% | 144 | 37% | 154 | 33% | 136 |

| 25 – 54 | 29% | 35% | 120 | 35% | 120 | 35% | 119 | 43% | 148 | 41% | 140 | 45% | 154 | 41% | 141 |

| 55+ | 13% | 19% | 141 | 17% | 128 | 15% | 111 | 17% | 127 | 14% | 104 | 13% | 94 | 13% | 96 |

| Women | |||||||||||||||

| 18 – 34 | 16% | 12% | 73 | 12% | 78 | 12% | 75 | 8% | 50 | 12% | 78 | 10% | 63 | 13% | 83 |

| 21 – 34 | 13% | 9% | 72 | 9% | 72 | 9% | 70 | 6% | 48 | 7% | 57 | 5% | 43 | 9% | 72 |

| 25 – 49 | 23% | 16% | 68 | 16% | 70 | 18% | 78 | 13% | 54 | 14% | 60 | 15% | 67 | 19% | 81 |

| 25 – 54 | 28% | 19% | 68 | 20% | 71 | 22% | 79 | 16% | 56 | 18% | 64 | 18% | 64 | 22% | 79 |

| 55+ | 16% | 13% | 82 | 13% | 83 | 13% | 82 | 10% | 64 | 8% | 52 | 7% | 45 | 7% | 45 |

| Ethnicity | |||||||||||||||

| White | 73% | 74% | 101 | 73% | 99 | 68% | 93 | 64% | 87 | 71% | 97 | 74% | 101 | 76% | 104 |

| Spanish origin | 41% | 34% | 83 | 42% | 102 | 41% | 100 | 35% | 86 | 32% | 78 | 64% | 157 | 79% | 194 |

| Black | 6% | 7% | 103 | 7% | 114 | 10% | 148 | 12% | 186 | 8% | 129 | 6% | 91 | 6% | 90 |

| Asian | 7% | 7% | 103 | 6% | 88 | 8% | 111 | 10% | 154 | 7% | 108 | 4% | 58 | 2% | 27 |

| Other | 14% | 13% | 92 | 14% | 102 | 15% | 106 | 14% | 103 | 13% | 97 | 17% | 120 | 17% | 121 |

| Education | |||||||||||||||

| Less than high school | 14% | 9% | 62 | 11% | 77 | 12% | 83 | 10% | 66 | 8% | 52 | 21% | 143 | 30% | 208 |

| High school graduate (or GED) | 30% | 28% | 93 | 30% | 99 | 28% | 94 | 25% | 84 | 25% | 84 | 33% | 111 | 34% | 115 |

| Some college (1-3 years) | 31% | 35% | 114 | 34% | 108 | 33% | 107 | 37% | 118 | 34% | 111 | 26% | 84 | 24% | 78 |

| College graduate (4 year college) | 14% | 15% | 104 | 14% | 99 | 15% | 105 | 15% | 109 | 19% | 137 | 11% | 80 | 7% | 46 |

| Postgraduate degree | 9% | 11% | 121 | 10% | 112 | 10% | 115 | 11% | 130 | 12% | 137 | 8% | 89 | 4% | 49 |

| Marital status | |||||||||||||||

| Never married (single) | 32% | 33% | 102 | 35% | 107 | 34% | 107 | 37% | 114 | 40% | 123 | 32% | 98 | 30% | 94 |

| Household income | |||||||||||||||

| Less than $35,000 | 29% | 21% | 72 | 24% | 82 | 25% | 87 | 22% | 75 | 19% | 67 | 35% | 121 | 43% | 150 |

| $35,000 – $49,999 | 19% | 19% | 98 | 20% | 102 | 19% | 97 | 18% | 94 | 12% | 61 | 19% | 98 | 22% | 112 |

| $50,000 – $74,999 | 15% | 15% | 100 | 15% | 100 | 16% | 104 | 16% | 107 | 16% | 103 | 13% | 82 | 12% | 76 |

| $75,000 – $99,999 | 14% | 17% | 122 | 15% | 108 | 14% | 99 | 14% | 104 | 18% | 132 | 14% | 104 | 14% | 99 |

| $100,000 – $249,999 | 19% | 25% | 126 | 23% | 120 | 23% | 117 | 25% | 129 | 30% | 155 | 17% | 89 | 9% | 48 |

| $250,000 or more | 4% | 4% | 104 | 4% | 100 | 4% | 117 | 5% | 131 | 5% | 142 | 2% | 68 | 1% | 33 |

| No. of children in HH , age 17 or under | |||||||||||||||

| None | 55% | 59% | 108 | 59% | 108 | 55% | 100 | 58% | 106 | 59% | 107 | 41% | 75 | 38% | 69 |

| One or more | 45% | 41% | 90 | 41% | 91 | 45% | 100 | 42% | 93 | 41% | 91 | 59% | 130 | 62% | 138 |

| Two or more | 29% | 26% | 89 | 26% | 90 | 27% | 94 | 25% | 86 | 23% | 81 | 38% | 133 | 46% | 161 |

| Three or more | 13% | 11% | 88 | 11% | 91 | 11% | 86 | 9% | 72 | 9% | 76 | 16% | 129 | 23% | 188 |

Source: Scarborough Research, ‘Los Angeles, CA 2012 Release 2.’ Based on 9,116 completed surveys, Aug. 2011-July 2012